The Stocks and Shares ISA is an investment vehicle used by millions across the UK. It’s essentially a wrapper that allows us to shelter our investment returns from taxation. That makes it incredibly efficient.

More than 4,000 people across the UK have used the wrapper to build portfolios worth over £1m. And, on average, it took them 22 years to hit the milestone figure.

This timeframe underscores the patient and calculated approach investors should adopt when leveraging the benefits of ISAs for long-term wealth accumulation.

So, how did they do it? And how could I do it too?

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Becoming a millionaire

It’s easier said than done. However, there are lots of hypothetical ways to become a Stocks and Shares ISA millionaire. It’s dependent on how much I contribute, for how long, and the rate of return.

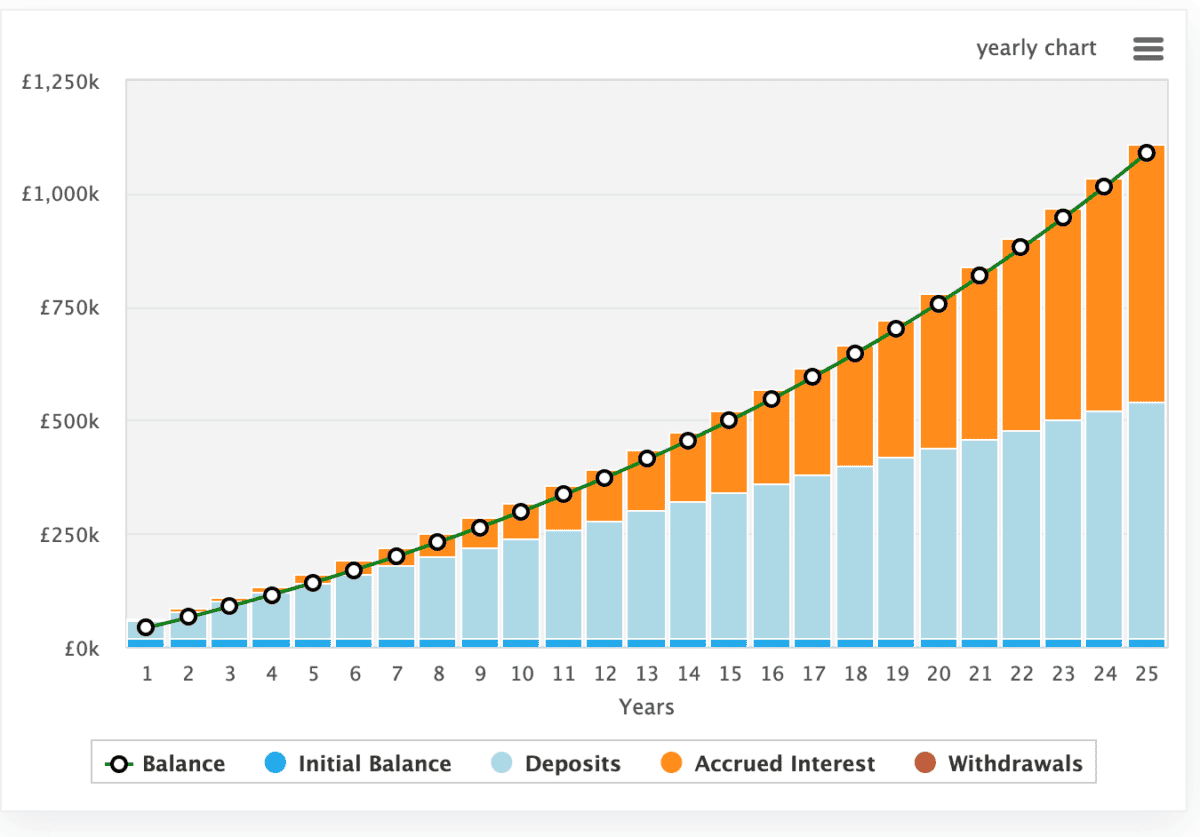

Investors can contribute up to £20,000 to their Stocks and Shares ISA every year. So, if I maxed out my ISA contributions every year and achieved an annualised return of 12%, it’d take me just 15 years to reach £1m. However, if I only achieved a 5% yield, it take me 25 years, as shown below.

Undervalued stocks

Of course, I’d love to become an ISA millionaire one day. Whether that’s going to happen, I’m not sure. Nonetheless, I’m enthusiastically embracing a disciplined and strategic approach to my financial journey.

I draw inspiration from the legendary Warren Buffett, investing in undervalued stocks as a cornerstone of my financial strategy.

Embracing Buffett’s principles of value investing, I aim to identify opportunities where the market has underestimated a stock’s true worth.

Value stocks

Buffett identifies value stocks by seeking companies with strong metrics, a durable competitive advantage, and a wide economic moat, protecting them from competition. But they’ve also got to have attractive valuation metrics.

That’s why I’ve recently invested in AppLovin, a US-based tech firm that helps companies maximise advertising revenue through their apps.

What makes it particularly attractive is its 0.67 forward price-to-earnings to growth (PEG) ratio — a ratio of one normally indicates fair value and below one is undervalued.

The stock also highlights, like Rolls-Royce, that surging stocks can still have very positive valuation metrics. Both AppLovin and Rolls-Royce shares have risen 180% over 12 months.

The PEG ratio assesses a stock’s valuation by considering both its price-to-earnings ratio and expected earnings growth, providing investors with a more comprehensive measure of a company’s potential value.

I’m also looking closely at companies with less of a competitive moat, but an even stronger PEG ratio. For example, Chinese EV manufacturer Li Auto is currently trading with a PEG ratio of 0.1.

I’m also looking at buying more of Lloyds, which has a PEG value of 0.5, and repurchasing Rolls-Royce, which also trades at 0.5 PEG.

While every investment carries risk, I’m hoping these companies can supercharge my portfolio moving forward.